Intel Reports Q4 2022 and FY 2022 Earnings: 2022 Goes Out on a Low Note

by Ryan Smith on January 26, 2023 6:00 PM EST- Posted in

- CPUs

- Intel

- Financial Results

- Lunar Lake

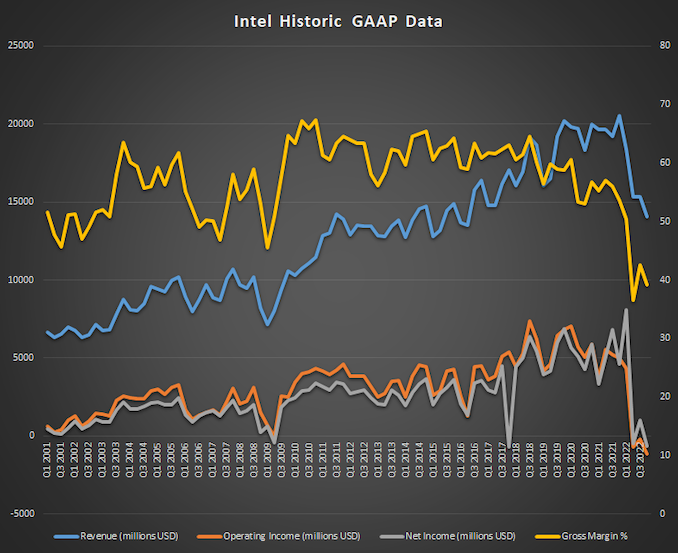

Kicking off yet another earnings season, we once again start with Intel. The reigning 800lb gorilla of the chipmaking world is reporting its Q4 2022 and full-year 2022 financial results, closing the book on what has turned an increasingly difficult year for the company. As Intel’s primary client and datacenter markets have reached saturation on the back of record sales and spending is slowing for the time being, Intel is seeing significant drops in revenue for both markets. These headwinds, though not unexpected, have broken Intel’s 6-year streak of record yearly revenue – and sent the company back into the red for the most recent quarter.

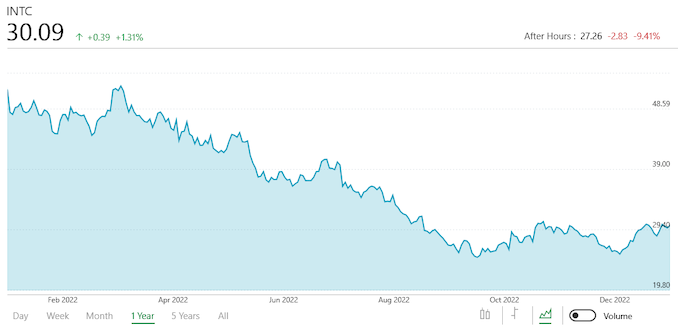

Starting with quarterly results, for the fourth quarter of 2022, Intel reported $14.0B in revenue, which is a major, 32% decline versus the year-ago quarter. With Intel coming off of what was their best Q4 ever just a year ago, as the saying goes: the higher the highs, the lower the lows. As a result, Q4’22 will go down in the books as a money-losing quarter for Intel (on a GAAP basis), with the company losing $661M for the quarter, a 114% decline in net income. Overall, Intel’s revenue for the quarter was low end of their already conservative forecasted range.

Looking briefly at GAAP versus non-GAAP figures, there’s a significant gap between the two, with the official GAAP net income coming in about $1.1B lower than its baseline counterpart – which is to say that Intel was at least in the black for its core business. To some extent it looks like Intel is using what was already a bad quarter to record some GAAP expenses (e.g. restructuring and inventory write downs), but at the end of the day the company has pretty consistent cost overhead, particularly on R&D and other fixed costs. So a significant drop in product sales comes right out of Intel’s bottom line. Ultimately, this has driven Intel’s quarterly gross margin down to just 39.2%, below Intel’s break-even point and well below the historical norm for the company.

Driving this drop has been roughly the same factors that have been a drag on Intel’s earnings for the last half year: after a spike in product sales during the pandemic, the processor market as a whole has reached saturation, sending both client and server sales down. And with the looming possibility of a recession, corporate and consumer buyers alike are being more conservative with their pocket books. At the same time, Intel hasn’t been helped by some of its product release cadences, such as the next-generation Sapphire Rapids server platform only finally launching a few weeks ago, in the first quarter of 2023.

| Intel Q4 2022 Financial Results (GAAP) | ||||||

| Q4'2022 | Q3'2022 | Q4'2021 | Y/Y | |||

| Revenue | $14.0B | $15.3B | $20.5B | -32% | ||

| Operating Income | -$1.1B | -$175M | $5.0B | -123% | ||

| Net Income | -$661M | $1.0B | $4.6B | -114% | ||

| Gross Margin | 39.2% | 42.6% | 53.6% | -14.5 ppt | ||

| Client Computing | $6.6B | $8.1B | $10.3B | -36% | ||

| Datacenter & AI | $4.3B | $4.2B | $6.4B | -33% | ||

| Network & Edge | $2.1B | $2.3B | $2.1B | -1% | ||

| Accelerated Computing Systems and Graphics | $247M | $185M | $245M | +1% | ||

| Mobileye | $565M | $450M | $356M | +59% | ||

| Intel Foundry Services | $319M | $171M | $245M | +30% | ||

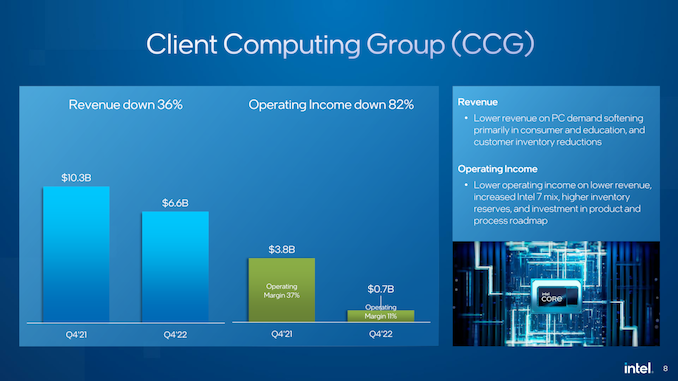

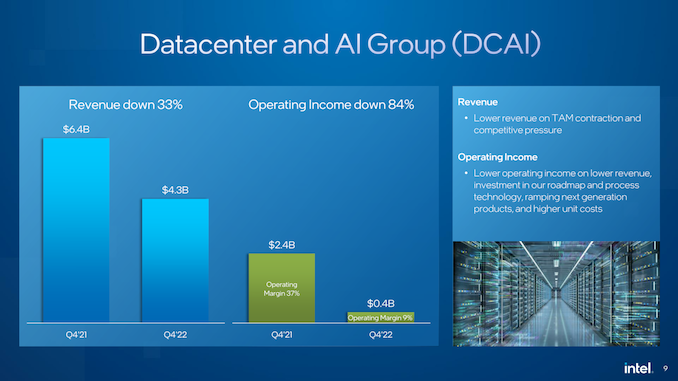

Breaking things down on a group basis, Intel’s two core business groups, client computing (CCG) and datacenter (DCAI) are both well off their revenue highs from last year. And in the case of CCG, revenues are down significantly even versus the prior quarter.

Despite a sizable 36% drop in operating revenue, Intel’s client group was still profitable on an operating basis, if only barely. Given that this is Intel’s biggest group by revenue, that’s a small victory – but with an operating income of only around $700M, it’s a very small victory indeed. As noted earlier, CCG is bearing the brunt of the boom and bust cycle set into motion by the pandemic, with lower end-user sales, and Intel’s OEM customers working to reduce the amount of inventory they’re holding on to.

Digging through Intel’s sheets, client notebook revenue was $3.66B, while client desktop revenue was $2.5B. Both are down over 30% versus the year-ago quarter, though notebook revenue saw the bigger drop, which is a bit of a concern since it’s the larger share of Intel’s client revenue to begin with. Intel has not disclosed any figures for average sale prices for this quarter, so it’s not clear how much of this decline is being driven by volume versus lower prices.

Meanwhile, datacenter & AI revenue was down 33% to $4.3B. This is a less precipitous drop than the client group, but only barely so. Though unlike Intel’s client sales, DCAI is facing challenges on more than just overall industry demand. Intel has been steadily losing server market share to reenergized rival AMD, who launched their latest generation of EPYC CPUs in Q4. Meanwhile Intel’s delayed next-generation Sapphire Rapids platform only finally launched a few weeks ago (Q5’22), so even among Intel’s most loyal datacenter customers, there has been a pause as they wait for Intel’s big server platform update to finally become available. All the while Intel has needed to continue investing in Emerald Rapids and beyond.

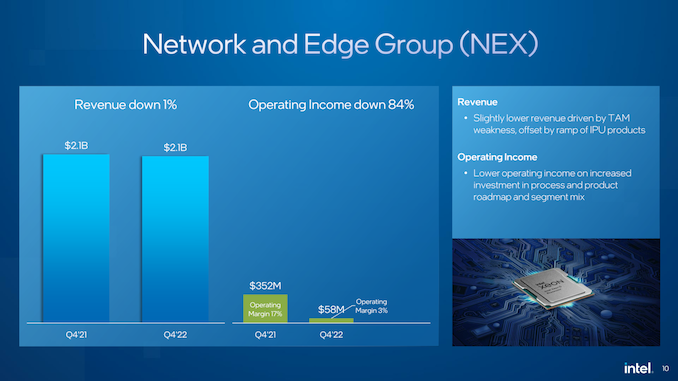

Moving down the list, Intel’s Network and Edge group also ended the quarter down on a year-ago basis, though faring much better overall and almost breaking even. All told, the group booked $2.1B in revenue, which was down 1% from Q4’21. Operating income was still down significantly, however, which Intel is attributing to investments in future products.

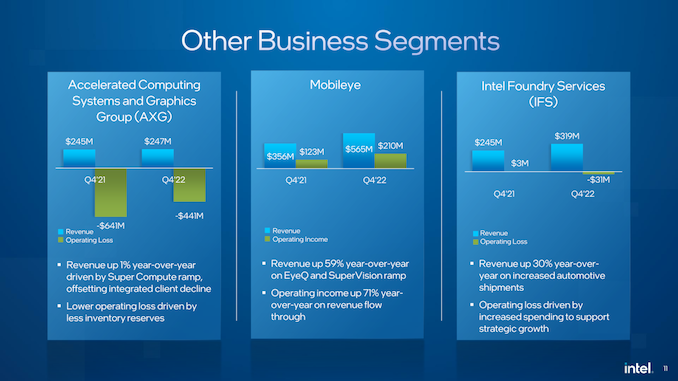

The silver lining for Intel for Q4’22, at least, is that outside of their billion dollar plus big revenue groups, the company’s smaller groups were all up for the quarter. Accelerated Computing Systems and Graphics (AXG) saw a slight revenue bump of 1%, as well as cutting its operating losses. Meanwhile Mobileye and Intel Foundry Services both saw significant year-over-year gains. In Mobileye’s case, the automotive group has continued to grow its market and revenues, and Intel successfully IPO’d Mobileye in Q4 (which helped to buoy the value of their investments). Meanwhile IFS continued to grow as Intel has picked up new customer commitments and overall orders have increased.

Full Year 2023

Shifting over to full year results, 2022 has served as a turning point in Intel’s earnings, which has made for a softer decline overall than Q4 alone, but still driven by the same factors that made Q4 such a rough quarter for Intel. Overall revenue was down 20% to $63.1B, and while this caused net income to fall 60%, notably Intel is still well in the black on a yearly basis, booking $8B for the complete year.

| Intel FY'2022 Financial Results (GAAP) | ||||||

| FY 2022 | FY 2021 | FY 2020 | Y/Y | |||

| Revenue | $63.1B | $79.0B | $77.9B | -20% | ||

| Operating Income | $2.3B | $19.5B | $23.7B | -88% | ||

| Net Income | $8.0B | $19.9B | $20.9B | -60% | ||

| Gross Margin | 42.6% | 55.4% | 56.0% | -12.8 ppt | ||

| Client Computing | $31.7B | $41.1B | N/A | -23% | ||

| Datacenter & AI | $19.2B | $22.7B | N/A | -15% | ||

| Network & Edge | $8.9B | $8.0B | N/A | +11% | ||

| Accelerated Computing Systems and Graphics | $837M | $774M | N/A | +8% | ||

| Mobileye | $1.9B | $1.4B | N/A | +35% | ||

| Intel Foundry Services | $895M | $786M | N/A | +14% | ||

This blend of both the better times and the worse times for Intel is reflected in Intel’s gross margins as well, which for the year were 42.6%. That’s down some 12.8 percentage points from 2021, so even stretched out over a year, 2022 was not a great year for Intel. Meanwhile, as a bit of a balance sheet curiosity, Intel’s net income for the year was well ahead of their meager $2.3B operating income. That gap is due to Intel’s investments and cash pile producing good returns, with investments alone netting the company over $4B in GAAP net income for the year.

As 2022 was the first year for Intel’s refactored business groups, the company has also provided like-for-like revenue comparisons for 2021. Like Intel’s overall revenue, the revenue drop for the company’s biggest units wasn’t quite as severe for the entire year, though by no means good news. Client revenue was down 23% on the year, while datacenter revenue was down 15%. Otherwise, all of Intel’s remaining business units recorded revenue growth for the year – with everything except AXG growing by double digits.

One other big shift for Intel’s balance sheets in FY 2022 versus 2021 has been Intel’s exit from the storage business. Whereas selling off their NAND business in 2021 was a net positive for Intel’s sheets in that year, for 2022 they’re having to take write-downs on their Optane memory products as the company works to exit that business entirely. Overall, Intel has taken a total of $723M in Optane inventory impairment charges for 2022, including $164M in the most recent quarter.

2022 Expectations

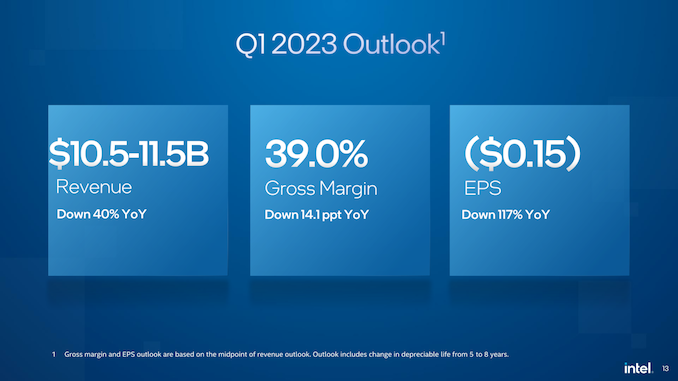

Though we tend not to focus too much on Intel’s future earnings forecasts, given the rough shape of the processor market right now, their predictions for Q1’2023 warrant a quick look.

In short, Intel is expecting things to get worse before they get better. The company’s official projection for Q1’23 is for revenue to come in some 40% lower than Q1’22, or a bit north of $10B. As a result, Intel’s gross margin is expected to remain soft at 39%, and Intel projects that Q1 will be another money-losing quarter with a negative EPS. Intel’s slides use non-GAAP, but the projected GAAP figure is even worse, at -$0.80 per share.

Going into 2023 will also be the first full year where Intel’s cost reduction strategy comes into play, which the company first embarked upon in the later half of last year. Trying to trim costs without upending the company or impacting the development of Intel’s next-generation fab processes, Intel is looking to cut $3B in costs for 2023.

Separate from those efforts, in another effort to cut expenses, Intel has disclosed that they are increasing the deprecation schedule for “certain production machinery and equipment” from 5 years to 8 years. Which is to say that Intel now expects to get a longer useful life out of this equipment than they were originally expecting and/or planning upon. As a result, Intel is expecting to reduce depreciation expenses in 2023 by roughly $4.2B. These changes are already baked into Intel’s earnings guidance for Q1’23, so as brutal as Intel’s Q1 projections currently look, technically things could be worse.

Finally, looking towards Intel’s product and process roadmap for the year, there is not much new to report for the moment. Intel remains steadfast on ramping up their Meteor Lake client SoC in the second half of this year, which will be Intel’s first client product built on their Intel 4 process. This will be followed by the brand-new Lunar Lake platform in 2024, which recently completed the initial tape-out for one of its tiles.

On the server side, now that Sapphire Rapids has launched, Intel is aiming to make up for lost time. The official server schedule is for Emerald Rapids to launch in the second half of this year, delivering a modest update to Intel’s Rapids platform. Emerald Rapids is an Intel 7 part like Sapphire, so for better and for worse, Intel won’t have the benefit of a new process node here – or the complexities of trying to bring up a large server part on such a node. Meanwhile Granite Rapids and Sierra Forest, which are both slated to be built on the Intel 3 process, remain on the schedule for 2024.

Otherwise, while the product updates tucked into Intel’s quarterly earnings are a fairly high-level overview of what’s to come, it’s notable that Intel doesn’t have anything new to talk about from their up-and-coming AXG GPU group. The last news on Rialto Bridge, Intel’s second-generation HPC accelerator, was that it wouldn’t start sampling until this year – so it’s unclear at best whether it will be shipping in any capacity this year. Similarly, the Battlemage architecture for client GPUs seems to be straddling the line between 2023 and 2024.

As for Intel’s fabs, there are no material changes being announced to Intel’s schedule. Intel 4 is officially “manufacturing ready” and Intel 3 is on track. Meanwhile Intel is in the process of fabbing the first test chips for their 20A and 18A processes. To that end, Intel still expects to kick off the High-NA era of silicon lithography in earnest in 2024.

36 Comments

View All Comments

name99 - Friday, January 27, 2023 - link

I don't know what you looked up.https://www.apple.com/newsroom/pdfs/FY22_Q4_Consol...

says that Mac sales were

$9,178M for 2021Q4 and

$11,508 for 2022Q4

that's 1.25x...

Things are equally cheery (14% increase) if we look at 2022 as a whole vs 2021 as a whole.

I'm not sure where you got unit sales from. Those are guesses rather than the audited sales numbers, and from quarter to quarter they tend to reflect what was released in that quarter (ie the quarter that releases new MBA's will have high unit sales, lower total sales; the quarter that releases Mac Studio will have higher total sales, lower unit sales).

Obsessing over unit sales rather than the overall pattern seems to me a way to try to avoid facing the truth.

ikjadoon - Saturday, January 28, 2023 - link

Apple doesn’t report unit sales anymore. Macs had an amazing Q4 2022 by revenue:Mac revenue: $11.51 billion, up 25.39% year-over-year

https://www.cnbc.com/2022/10/27/apple-aapl-earning...

They aren’t immune from everything, but they are wholly immune from Wintel & AMD.

Wrs - Saturday, January 28, 2023 - link

Apple have not reported for calendar q4 2022. They will in a few days, calling it fiscal q1 2023.flgt - Saturday, January 28, 2023 - link

I think most of the products that were in the market during the pandemic were roadmapped by the previous management. These next few releases will be where we really find out if Gelsinger was the right guy to turn them around.The Von Matrices - Thursday, January 26, 2023 - link

FYI extending the depreciation schedule from 5 to 8 years has nothing to do with the useful life of the equipment becoming longer.You extend the depreciation schedule if the business has low or negative profits in the near term so that you can use the tax deductions in later years when the business is making profits. You are wasting the deductions if you can only take them in the years when the business is losing money.

michael2k - Friday, January 27, 2023 - link

But isn’t that the same as keeping a capital asset in service longer?Speedfriend - Friday, January 27, 2023 - link

Accounting depreciation isn't always the same as tax depreciation, so it may well have no tax impact at all. Given ASML recently reported strong growth from 'field upgrades' I suspect fabs are keeping machinery longer through upgradesikjadoon - Saturday, January 28, 2023 - link

Yup. It’s just accounting tricks to misleading pump up margins:“ Rasgon was most agog at the company’s profit margin of 39.2% in the quarter, which he said would have been three points lower if Intel had not made an accounting change to extend the depreciation of certain machinery and equipment by three years.”

flgt - Saturday, January 28, 2023 - link

I don’t understand how it helped their current year margins. @The Von Matrices statement made sense if they are pushing that depreciation out to future years where they hopefully are profitable. The depreciation amount is the purchase price divided up over the schedule, so if the schedule extends this years write off is less.Otritus - Friday, February 3, 2023 - link

If I have $1000 amortizing over 10 years, that’s $100 per year in costs. If it’s over 5 years the costs rise to $200. By depreciating over 8 years instead of 5 Intel’s costs this year will go down. Lower costs means higher margins. It’s purely an accounting trick though because Intel already spent the money to acquire the capital goods, and is just changing when they claim to have it paid for.