Intel Reports Q3 2021 Earnings: Client Down, Data Center and IoT Up

by Ryan Smith on October 21, 2021 5:30 PM EST- Posted in

- CPUs

- Intel

- Financial Results

- IFS

Kicking off another earnings season, Intel is once again leading the pack of semiconductor companies in reporting their earnings for the most recent quarter. As the company gets ready to go into the holiday quarter, they are coming off what’s largely been a quiet quarter for the chip maker, as Intel didn’t launch any major products in Q3. Instead, Intel’s most recent quarter has been driven by ongoing sales of existing products, with most of Intel’s business segments seeing broad recoveries or other forms of growth in the last year.

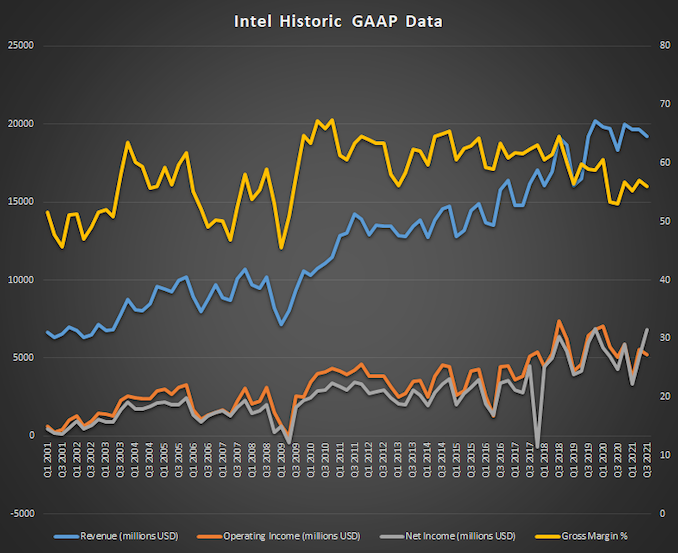

For the third quarter of 2021, Intel reported $19.2B in revenue, a $900M improvement over the year-ago quarter. Intel’s profitability has also continued to grow – even faster than overall revenues – with Intel booking $6.8B in net income for the quarter, dwarfing Q3’2020’s “mere” $4.3B. Unsurprisingly, that net income growth has been fueled in part by higher gross margins; Intel’s overall gross margin for the quarter was 56%, up nearly 3 percentage points from last year.

| Intel Q3 2021 Financial Results (GAAP) | |||||

| Q3'2021 | Q2'2021 | Q3'2020 | |||

| Revenue | $19.2B | $19.7B | $18.3B | ||

| Operating Income | $5.2B | $5.7B | $5.1B | ||

| Net Income | $6.8B | $5.1B | $4.3B | ||

| Gross Margin | 56.0% | 53.3% | 53.1% | ||

| Client Computing Group Revenue | $9.7B | -4% | -2% | ||

| Data Center Group Revenue | $6.5B | flat | +10% | ||

| Internet of Things Group Revenue | $1.0B | +2% | +54% | ||

| Mobileye Revenue | $326M | flat | +39% | ||

| Non-Volatile Memory Solutions Group | $1.1B | flat | -4% | ||

| Programmable Solutions Group | $478M | -2% | +16% | ||

Breaking things down by Intel’s individual business groups, most of Intel’s groups have enjoyed significant growth over the year-ago quarter. The only groups not to report gains are Intel’s Client Computing Group (though this is their largest group) and their Non-Volatile Memory Solutions Group, which Intel is in the process of selling to SK Hynix.

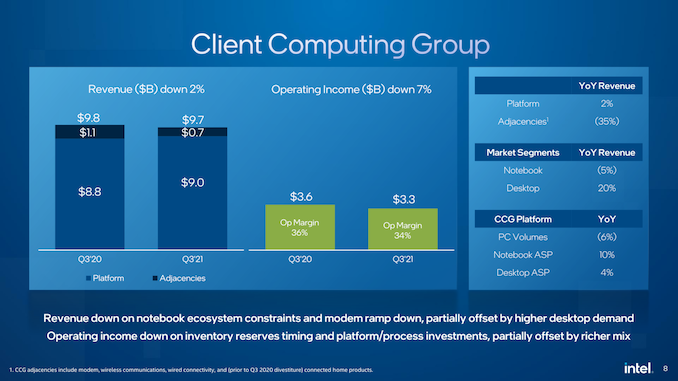

Starting with the CCG then, Intel’s core group is unfortunately also the only one struggling to grow right now. With $9.7B in revenue, it’s down just 2% from Q3’2020, but that’s something that stands out when Intel’s other groups are doing so well. Further breaking down the numbers, platform revenue overall is actually up 2% on the year, but non-platform revenue – “adjacencies” as Intel terms them, such as their modem and wireless communications product lines – are down significantly. On the whole this isn’t too surprising since Intel is in the process of winding down its modem business anyhow as part of that sale to Apple, but it’s an extra drag that Intel could do without.

The bigger thorn in Intel’s side at the moment, according to the company, is the ongoing chip crunch, which has limited laptop sales. With Intel’s OEM partners unable to source enough components to build as many laptops as they’d like, it has the knock-on effect of reducing their CPU orders, even though Intel itself doesn’t seem to be having production issues. The upshot, at least, is that desktop sales are up significantly versus the year-ago quarter, and that average selling prices (ASPs) for both desktop and notebook chips are up.

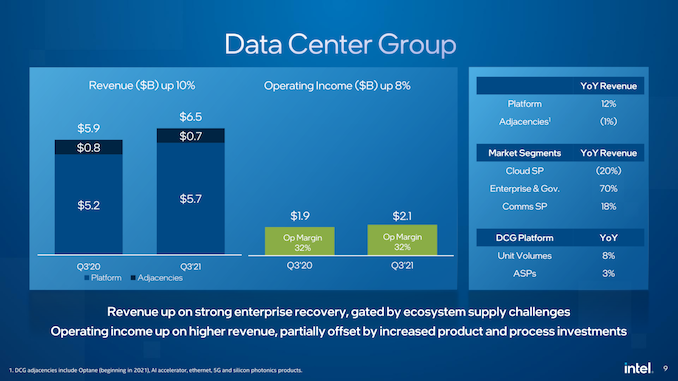

Meanwhile, Intel’s Data Center Group is enjoying a recovery in enterprise spending, pushing revenues higher. DCG’s revenue grew 10% year-over-year, with both sales volume and ASPs increasing by several percent on the back of their Ice Lake Xeon processors. A bit more surprising here is that Intel believes they could be doing even better if not for the chip crunch; higher margin products like servers are typically not impacted as much by these sorts of shortages, since server makers have the means to pay for priority.

Unfortunately, unlike Q2 Intel isn’t providing a quarter-over-quarter (i.e. vs the previous quarter) figures for their earnings presentation. So while overall DCG revenue is flat on a quarterly basis, it sounds like Intel hasn’t really recovered from the hit they took in Q2. Meanwhile, commerntary on Intel's earnings call suggests the sales of the largest (XCC) Ice Lake Xeons has been softer than Intel first expected, which has kept ASP growth down in an otherwise DCG-centric quarter.

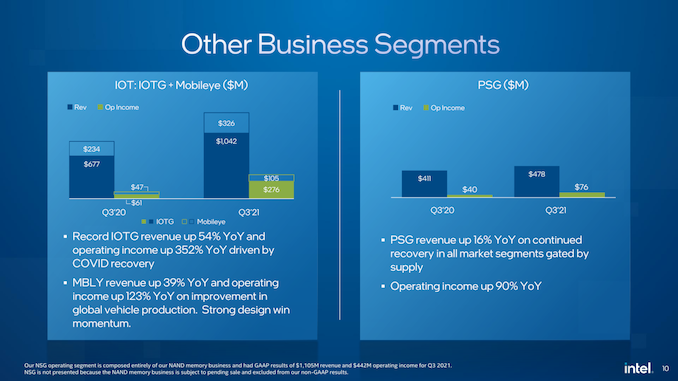

The third quarter was also kind to Intel’s IoT groups and their Programmable Solutions Group. All three groups are up by double-digit percentages on a YoY basis, particularly the Internet of Things Group (IoTG), which is up 54%. According to Intel, that IOTG growth is largely due to businesses recovering from the pandemic, with a similar story for the Mobileye group thanks to automotive production having ramped back up versus its 2020 lows.

Otherwise, Intel’s final group, the Non-Volatile Memory Solutions Group, was the other declining group for the quarter. At this point Intel has officially excised the group’s figures from their non-GAAP reporting, and while they’re still required to report those figures in GAAP reports, they aren’t further commenting on a business that will soon no longer be theirs.

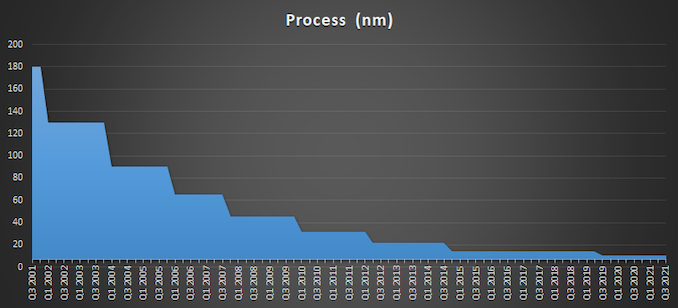

Finally, tucked inside Intel’s presentation deck is an interesting note: Intel Foundry Services (IFS) has shipped its first revenue wafers. Intel is, of course, betting heavily on IFS becoming a cornerstone of its overall chip-making business in the future as part of its IDM 2.0 strategy, so shipping customers’ chips for revenue is an important first step in that process. Intel has laid out a very aggressive process roadmap leading up to 20A in 2024, and IFS’s success will hinge on whether they can hit those manufacture ring technology targets.

For Intel, Q3’2021 was overall a decent quarter for the group – though what’s decent is relative. With the DCG, IOTG, and Mobileye groups all setting revenue records for the quarter (and for IOTG, overall records), Intel continues to grow. On the flip side, however, Intel missed their own revenue projections for the quarter by around $100M, so in that respect they’ve come in below where they intended to be. And judging from the 7% drop in the stock price during after-hours trading, investors are taking note.

Looking forward, Intel is going into the all-important Q4 holiday sales period, typically their biggest quarter of the year. At this point the company is projecting that it will book $18.3B in non-GAAP revenue (excluding NSG), which would be a decline of 5% versus Q4’2020. Similarly, the company is expecting gross margins to come back down a bit, forecasting a 53.5% margin for the quarter. On the product front, Q4 will see the launch of the company’s Alder Lake family of processors, though initial CPU launches and their relatively low volumes tend not to move the needle too much.

On that note, Intel’s Innovation event is scheduled to take place next week, on the 27th and 28th. The two day event is a successor-of-sorts to Intel’s IDF program, and we should find out more about the Alder Lake architecture and Intel’s specific product plans at that time.

Source: Intel

32 Comments

View All Comments

Oxford Guy - Sunday, October 24, 2021 - link

Apple during the Performa era.zepi - Sunday, October 24, 2021 - link

As a long term "intel investor" I don't have R&D. I love it. But history has proven that R&D can fail, and risk of this failure (ie. billions of invested, almost nothing comes out) has to be priced into the expected value of the stock.TheJian - Friday, October 22, 2021 - link

I'll say it again, Intel isn't losing. 6.8B Net...ROFLMAO...Yeah, Wake me when AMD can make that in a year (2? ;)). Is that a record? Must be close, and while AMD is supposedly destroying them...LOL. If AMD wants to make more NET INCOME, stop making console socs for peanuts and wasting dies that could all be SERVER/HEDT etc for thousands each instead of $10-15 profits on each soc (both use about the same amount of silicon roughly, so make the expensive stuff!! FFS!).Teckk - Friday, October 22, 2021 - link

Why are you concerned so much about AMD, you mention AMD more than Intel in your comment.Qasar - Saturday, October 23, 2021 - link

ignore thejian, the only time i see him post on here, are in posts like this, and most of them, are anti amd in some way. its quite comic how dumb his posts are.Blastdoor - Friday, October 22, 2021 - link

Too bad AMD isn't their only competitor. This isn't 2006.msroadkill612 - Friday, October 22, 2021 - link

This is a very rose tinted view of what other analysts & the markets objectively view as a dismal result.Woofram - Friday, October 22, 2021 - link

I am honestly somewhat surprised by the price movement on Intel, seems very short-sighted (though I guess Wall Street only looks a quarter or two ahead). I think Gelsinger has a real shot at saving the company, but indeed if Wall Street keeps dumping the stock, Gelsinger may lose financial motivation to continue leading the company, and will just quit, since his stock option reward is, AFAIK, based in part on stock performance.The problem with Intel has been that, for the past 20 years, they've had complete loser CEOs (read: non-electrical engineers). I don't know who in their right mind would allow someone to lead a 100K employee, $80B revenue company that doesn't have a foundational understanding of the underlying technology involved. However, like Jensen Huang and Lisa Su, Intel finally has an electrical engineer running the company. Per Wiki, Gelsinger was previously Intel's CTO and designed the 80486 CPU, which evolved into the Pentium CPU, which IMO are the sort of qualifications you'd want in a CEO, not someone that was a CFO or COO. When you have finance or managerial folk running the company, you wind up in scenarios where you're only accomplishment is bribing Dell to not buy competitor chips and getting sued for billions of dollars, or failing to reach 10nm and having no contingency plan for 5+ years.

Gelsinger, on the other hand, is finally making all the right moves. He's dissociated the chip design business from the foundry business, and opened up the foundry business to take orders from other companies. Anyone that thinks that having a foundry is bad business is delusional. TSMC makes double the profit on the same revenue as Intel. And Intel, who indeed has been non-competitive, still managed to earn more profit on their revenue than Nvidia or AMD, who are 4x/8x smaller (and have 6x/3x higher valuations, respectively). I would expect it to be harder to maintain profitably as you grow in size.

The problem that AMD had when it had Global Foundries was that AMD, like Intel up until recently, only used their own fab to produce their designs. As a result, the entire success of the company depended on having the most advanced process, and the moment you fall behind, you end up on a sinking ship. Since Intel, as AMD, are now allowing TSMC to produce their chips, Intel can now have both aspects of their business be successful without depending on their fab having the most bleeding edge process. As we all know from last year, any fab will have an endless supply of orders regardless of node size for the foreseeable future. This uncoupling means their foundry business can take all the time it needs to ensure fabrication at any given new node size will be successful without imposing risks or delays to the roadmap of their chip design business, which ultimately means that with proper investment, there's no reason to think Intel won't be capable of retaking fabrication leadership, or at least be competitive, once their new plants come online. And if/when they end up being competitive enough at a given node, their design business can reap those benefits and produce even better margins.

And I haven't even touched on the fact that they're finally getting into the discrete GPU market, which is clearly a nudge towards data center growth, i.e. Nvidia's play. The fact that their data center business is still growing is more important IMO than the fact that they lost some CCG revenue. Hence, at their current valuation relative to AMD, Nvidia, and even TSMC, would seem like an absolute steal.

Oxford Guy - Sunday, October 24, 2021 - link

Having TSMC do their GPUs conveniently enables GPU prices to remain sky high.Helmery - Saturday, October 23, 2021 - link

Intel problem is about zero competition since core2duo, hence home of thousand "sleepy joe" engineers.