GlobalFoundries To Spend Billions: Doubling Fab 8, Creating New Fab in NY

by Dr. Ian Cutress on July 19, 2021 11:36 AM EST- Posted in

- GlobalFoundries

- Semiconductors

- Fab 8

- Malta

Today at a private GlobalFoundies event, CEO Tom Caulfield accompanied by Senate Majority Leader Chuck Schumer, announced that the company is set on expansion. At the heart of this new initiative is a doubling of Fab 8, GF’s leading manufacturing facility, at the cost of around $1B. Accompanying this is the disclosure that GF is going to build another manufacturing facility close to Fab 8, in Malta NY, as part of a Private-Public partnership. Details of the new facility were not given.

GlobalFoundries is a contract manufacturer of microprocessors, focusing on adjacency technologies from 12nm and larger geometries. While most column inches are spent discussing the leading-edge manufacturing at GF’s competitors, in a discussion with the CEO we were told that GF addresses around 70% of the semiconductor market and in the current climate is currently running all of its facilities at maximum production.

GF has three main fabs in Malta NY, Dresden Germany, and Singapore – all three are running at maximum output, and GF recently announced a new plant in Singapore capable of 450K wafers per year. Tom Caulfield told us prior to that announcement that the Malta fab is around two-thirds full of equipment, Dresden is at about half, but Singapore is full, hence the new Singapore fab. In March GF announced a $1.4B expansion divided equally between the three sites, with Production capacity is expected to increase by 13% this year and by 20% next year as a result of the increased funding. Today’s announcement commits to adding additional machines at Malta to scale out to the space already there, for another 150k wafers per year, at a cost of $1B.

New website with the new branding. They should have put 'Moore'

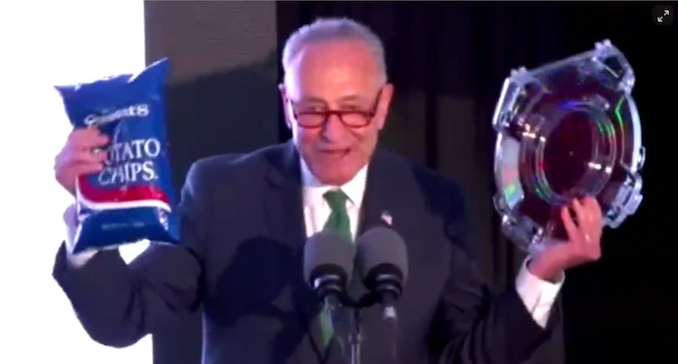

The other element of the announcement is the new fab in Malta. The deployment of a new facility, especially at scale, costs billions. GlobalFoundries today acknowledges that it will take billions, citing the US government’s desire to increase national manufacturing in light of the global scale and building more on American soil. Exactly how GF will implement a new facility has not been disclosed – no timeline, no costs, no information about where the funding is coming from, or what process nodes will be manufactured on-site. It was announced that it would be a private-public partnership, developing chips for high-growth areas such as automotive, 5G, and IoT. The fab is set to create 1000 technical jobs and another few thousand in ancillary positions in the local area to support it. Discussions were also made in light of the semiconductor supply chain, and the need to invest and evolve that part of the business alongside manufacturing improvements. Senator Schumer spoke about the need to pass grow semiconductors, holding up a bag of chips alongside a wafer.

These announcements are part of a train of recent disclosures and talk about GlobalFoundries. Last week it was rumored that Intel was seeking to acquire GF for $30 billion, however today GF announced a complete logo change and rebranding of the business, which doesn’t tend to occur if a company is in the process of acquisition talks. Alongside this, GF is expected to bring forward its Initial Public Offering (IPO) from 2022 to late 2021. The company is currently owned wholly by the Emerati state holding company Mubadala, and the IPO is on the back of some growth of GF in light of the high semiconductor demand environment. GlobalFoundries expects 2021 revenue to be around $6.2 billion, a +9% growth over 2020.

Official Press Release from GlobalFoundries

Related Reading

- GlobalFoundries To Build New 450K Wafer-per-Year Fab in Singapore

- AMD and GlobalFoundries Update Wafer Supply Agreement: Orders Through 2024, Now Non-Exclusive

- GlobalFoundries Upgrades for Silicon Photonics in Quantum Computers

- GlobalFoundries to Invest $1.4B in Expansion, Potential Earlier IPO

- GlobalFoundries' 22FDX with MRAM is Ready

- GlobalFoundries and SiFive to Design HBM2E Implementation on 12LP/12LP+

- GlobalFoundries and TSMC Sign Broad Cross-Licensing Agreement, Dismiss Lawsuits

74 Comments

View All Comments

mode_13h - Thursday, July 22, 2021 - link

I know you love playing the cynic, but even with some degree of state-capture, it's still capitalism.Oxford Guy - Monday, July 26, 2021 - link

You forgot to insert word ‘called’ in there.mode_13h - Tuesday, July 27, 2021 - link

No, I said what I meant.There's free and open competition, for the most part. That's capitalism.

Oxford Guy - Wednesday, July 28, 2021 - link

Uh huh.bobby Valentino - Tuesday, July 20, 2021 - link

Lol, the potato chip was invented in the town next door, it was a worthy point he made. Thanks try again.boozed - Monday, July 19, 2021 - link

"Senator Schumer spoke about the need to pass grow semiconductors"Is this a typo? If not what does it mean?

Thunder 57 - Monday, July 19, 2021 - link

I was wondering the same thing. Nice name, BTW.eldakka - Monday, July 19, 2021 - link

With all these manufacturers (TSMC, Samsung, Intel, some other non-bleeding edge fabs whom I forget, and now GF) announcing huge expansion plans, I'm just wating for the semiconductor glut in 3 years and all the fabs complaining about too much supply driving prices down too much so they start losing money ...Soon it'll look like the memory industry that's on a 4-year oversupply (low prices)/undersupply (high prices) cycle.

Wereweeb - Tuesday, July 20, 2021 - link

Naturally, and then they'll start asking for tax cuts, subsidies, etc...They're expanding right now because governments are giving them the money to expand. Something something socialized losses, privatized profits.

FunBunny2 - Tuesday, July 20, 2021 - link

"the semiconductor glut in 3 years"it could be sooner. it's going to dawn on folks that 5G is the end of the line for cellular. everyone, even Verizon, "cannea change the laws of physics, Capn!" it makes no difference that ever smaller nodes could fit some hypothetical 6G radio in a frame, there would have to be a 'cell' every line-of-sight 30 feet away, using bandwidth that may not even exist. phones have been the growth driver for a couple decades. some may say that Moore's Law will always pertain, but using such devices in practical devices may not.