GlobalFoundries Stops All 7nm Development: Opts To Focus on Specialized Processes

by Anton Shilov & Ian Cutress on August 27, 2018 4:01 PM EST- Posted in

- Semiconductors

- CPUs

- AMD

- GlobalFoundries

- 7nm

- 7LP

GlobalFoundries on Monday announced an important strategy shift. The contract maker of semiconductors decided to cease development of bleeding edge manufacturing technologies and stop all work on its 7LP (7 nm) fabrication processes, which will not be used for any client. Instead, the company will focus on specialized process technologies for clients in emerging high-growth markets. These technologies will initially be based on the company’s 14LPP/12LP platform and will include RF, embedded memory, and low power features. Because of the strategy shift, GF will cut 5% of its staff as well as renegotiate its WSA and IP-related deals with AMD and IBM. In a bid to understand more what is going on, we sat down with Gary Patton, CTO of GlobalFoundries.

7LP Canned Due to Strategy Shift

GlobalFoundries was on track to tape out its clients’ first chips made using its 7 nm process technology in the fourth quarter of this year, but “a few weeks ago” the company decided to take a drastic, strategic turn, says Gary Patton. The CTO stressed that the decision was made not based on technical issues that the company faced, but on a careful consideration of business opportunities the company had with its 7LP platform as well as financial concerns.

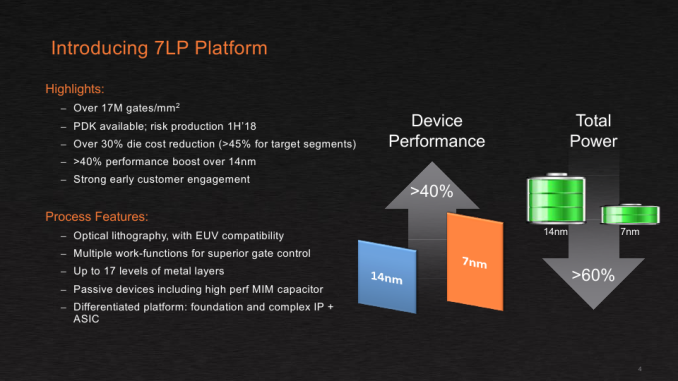

It is noteworthy that when GlobalFoundries first announced its 7LP platform in September 2016, it said that it would start risk production of processors using this technology in early 2018 (PR), which means that the first chips should have been taped out before that. When the company detailed the process in June 2018, it said that it expected to start “volume production ramping in the second half of 2018” (PR), which would be close to impossible if customers taped out their first chips only in Q4.

Generally, it looks like the company had to adjust its roadmap somewhere along the way, moving the start of high-volume manufacturing (HVM) further into 2019. Whether or not these adjustments had any implications on GlobalFoundries is up to debate. Keep in mind that AMD’s first 7 nm product was designed for TSMC’s CLN7FF from the beginning, so the company did not bet on GF’s 7LP in late 2018 anyway, and no rush with the manufacturing technology was needed for GF’s key customer.

Along with the cancellation of the 7LP, GlobalFoundries essentially canned all pathfinding and research operations for 5 nm and 3 nm nodes. The company will continue to work with the IBM Research Alliance (in Albany, NY) until the end of this year, but GlobalFoundries is not sure it makes sense to invest in R&D for ‘bleeding edge’ nodes given that it does not plan to use them any time soon. The manufacturer will continue to cooperate with IMEC, which works on a broader set of technologies that will be useful for GF’s upcoming specialized fabrication processes, but obviously it will refocus its priorities there as well (more on GF’s future process technologies later in this article).

So, the key takeaway here is that while the 7LP platform was a bit behind TSMC’s CLN7FF when it comes to HVM – and GlobalFoundries has never been first to market with leading edge bulk manufacturing technologies anyway – there were no issues with the fabrication process itself. Rather there were deeper economic reasons behind the decision.

Economic Reasons Behind the Move

As we noted in our article covering GlobalFoundries's new CEO hire earlier this year, former CEO Sanjay Jha was never able to make the company profitable. His key tasks were to increase GlobalFoundries’s sales, streamline the company in general, and ensure that it executes its roadmap.

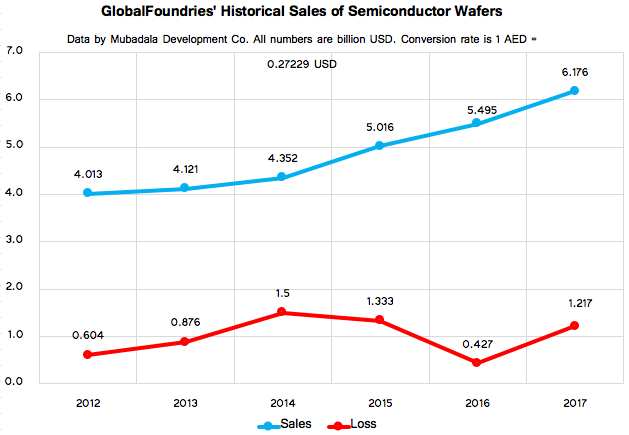

To address the needs of the manufacturer’s traditional key client (AMD) and ensure that his company was competitive against other contract makers of semiconductors, he licensed Samsung Foundry's 14LPP fabrication technology. That strategy worked well. With Sunjay Jha at the helm, GlobalFoundries has managed to land a variety of new customers and increase its sales of semiconductor wafers from approximately $4.121 billion in 2013 to $6.176 billion in 2017. Besides, the foundry’s leading-edge Fab 8, which has been processing wafers using exclusively 14LPP process technology for well over 1.5 years now, is running at full capacity.

To ensure that GlobalFoundries remains competitive against Samsung Foundry and TSMC in the long run, Sunjay Jha obtained IP and development teams from IBM (along with two fabs and a lot of obligations), and poured in billions of dollars in development of the 7LP fabrication technology platform. The latter would include three generations of manufacturing processes and, possibly, a custom high-performance technology available exclusively to IBM. While everything appeared to proceed smoothly with the 1st Gen 7 nm process (DUV only), the 2nd Gen 7 nm process (with EUV used for non-critical layers, such as padding) still needed some additional development investments, and the 3rd Gen 7 nm (with intensive usage of EUV) required even more money for development and further could require installation of additional EUV equipment. Meanwhile, there were two things to consider.

First. If GlobalFoundries kicks off production using the 1st Gen 7 nm fabrication process, it would have needed to cure all of its teething troubles and offer its clients a roadmap forward. The latter would have included 2nd Gen and 3rd Gen 7 nm, but nothing stops there. Customers would have asked for 5 nm and then for 3 nm nodes. Meanwhile, you cannot tell your clients that you are packing up after a certain node and then hope that this node will be a success (the same is true for DUV-only 1st Gen 7 nm).

Second. Development of leading-edge process technologies is extremely expensive. Every new node requires billions of dollars in investments. Those costs are eventually amortized over each chip the company makes, so to keep increasing R&D costs from driving up chip prices, foundries need to produce more chips. To make more chips, they need to either run multiple fabs that use the same process technology (these are going to cost $10+ billion in the EUV era), or build giant fabs that process a gargantuan number of wafers (these are going to cost $20+ billion in the EUV era). Meanwhile, GlobalFoundries has only one leading-edge fab featuring capacity of 60,000 wafer starts per month. As a result, either GlobalFoundries has to pass these R&D costs on to the finite number of wafers it processes – and become uncompetitive against rivals in the process – or eat the costs with reduced profitability.

Meanwhile, having spent well over $20 billion on GlobalFoundries over the last 10 years, Mubadala, the owner of the company, is not inclined to lose more money or invest tens of billions in the hopes of becoming profitable one day. The investor wants GlobalFoundries to stop bleeding and start generating profits.

“The culture of [our investments], the ones I’ve been involved with, was about accumulating assets and then just maintaining it,” said Mubadala CEO Khaldoon Al Mubarak in an interview with Bloomberg earlier this year. “The shift that has happened over the last couple of years, that I’ve tried to push at Mubadala today, is a monetization strategy that makes sense, not with a view to cash out but with a view to reinvest.”

Gary Patton admits that GlobalFoundries never planned to be a leading producer of 7-nm chips in terms of volume. Furthermore, the company has been seeing increasing adoption of its 14LPP/12LP technologies by designers of various emerging devices, keeping Fab 8 busy and leaving fewer step-and-scan systems for 7LP products.

Without another big fab, it would be impossible to make any new leading-edge process technology competitive against Samsung and TSMC due to aforementioned scale reasons. Meanwhile, building a new fab (or even expanding the Fab 8 with another clean room module, which is something that GF considered several years ago) and creating another node or two would require another $10 – $15 billion from Mubadala, which is not inclined to invest just now. As a result, the GlobalFoundries has decided to switch entirely to specialized process technologies for emerging high-growth markets. This strategic shift enables it to reduce spending on R&D, slowdown procurement of new equipment, reduce its workforce by 5% (most of which will be in Malta), and potentially avoid direct competition against the aforementioned contract makers of semiconductors.

127 Comments

View All Comments

Alexvrb - Tuesday, August 28, 2018 - link

LOL let's bring Fujitsu into an argument as a good example of how to win... LMAO. How's Fujitsu doing in the fab biz, again?NuclearArmament - Tuesday, August 28, 2018 - link

More companies would do better by having their own fabs, not less. Being vertically integrated via either merger, acquisition, or organic means is a much better way to remain competitive than solely remaining fabless and outsourcing. Intel is only as large as they are in the semiconductor world because they did not so foolishly sell off all their fabrication facilities like AMD did.FunBunny2 - Tuesday, August 28, 2018 - link

"More companies would do better by having their own fabs, not less. "I've always been puzzled about how much scale there really is. ASML (and who else?) supply the fundamental equipment that all fabs use. did ASMl/whoever figure out, say EUV, and supply all the fabs; or did Samsung, say, figure it out and ASML/whoever built the machines to Samsung/whoever's spec?? from the picture of fabs I've seen, it looks very much like some number of sequential, discrete work-stations, repeated X times. it's not like a car assembly line, where one line makes all the cars.

mikato - Tuesday, August 28, 2018 - link

Yeah I noticed that too. The first photo makes it look like there are a bunch of semi-mobile machines arranged in groups forming the stations. Then the next photo might be more of an assembly line - at least it has a bunch of overhead tracks for things to move along, not sure what, maybe transporting items around.RSAUser - Tuesday, August 28, 2018 - link

It wasn't foolish for AMD to sell, TSMC is a lot cheaper for them than global while being on a better node ans AMD not having the money to invest in smaller nodes.Going TSMC they are at least mostly competitive in the node portion of the cards.

Spunjji - Tuesday, August 28, 2018 - link

You're either trolling or a fool to suggest that selling the fabs was a bad idea for AMD. For a company of that size they're nothing but a millstone. They limited their output capacity when AMD actually had good processors to sell, and then cost them billions when they didn't have a competitive product.The stupid bit was the agreement to produce a minimum number of wafer stars with GF after they sold the fabs. That bit them hard in the financials.

FullmetalTitan - Thursday, August 30, 2018 - link

Smart guy over here figured out the secret to business success in semiconductors if you ignore...*checks notes*

...the need for decades of R&D and many 10s of billions of dollars to acquire companies to supply goods, design products, and leverage talent.

gglaw - Sunday, December 16, 2018 - link

LOLOL. Yea AMD is doing horrible since they sold off their outdated fabs and are paying less for superior nodes now. Their stocks have just plummeted in the last few years. The investors are super pissed that their $3 stocks have gone up to $20 since they don't run their own fabs (which btw is on their own way down the drain after sinking billions into 7nm R&D and scrapping it to focus on old nodes). Look at AMD's balance sheets, then look at TSMC or Samsung. It's 1B vs FIVE HUNDRED BILLION cash on hand. AMD is a tiny designer of fancy chips compared to massive semi-conductor firms that produce chips for the whole world. Even Intel is a speck compared to these companies and more than a few analysts feel Intel's best future move is also letting TSMC use their much deeper pockets to compete in bleeding edge node wars. (If you haven't noticed, Intel is getting the shit kicked out of them in node advancement.)gglaw - Sunday, December 16, 2018 - link

The savings from vertical integration is absolutely nothing compared to the R&D costs and ramping up manufacturing facilities for each new node. Even if the vertical integration made the wafers literally free, it would forever run AMD in the red trying to pay for the R&D and new facilities for a tiny fraction of the chips sold required to justify the cost of each node advancement. AMD would have to sell over 100X the amount of chips they did in 2018 to maintain a fab that could keep up with TSMC and Samsung. TSMC can do it since they sell a staggering amount of chips compared to either AMD or Intel. AMD accounts for under 1% of TSMC's contracted chips produced. In the tech enthusiast world, AMD is very exciting since they play such a large roll in gaming hardware design but in the business world, they're a little ant.transistortechnologist - Tuesday, August 28, 2018 - link

It turns out that at very small dimensions compound semiconductors such indium gallium arsenide do not offer any benefits over silicon. It's fundamental, in the physics, quite apart from any economic considerations.